Insurance vs Cash Pay: What Really Saves You Money on Medications

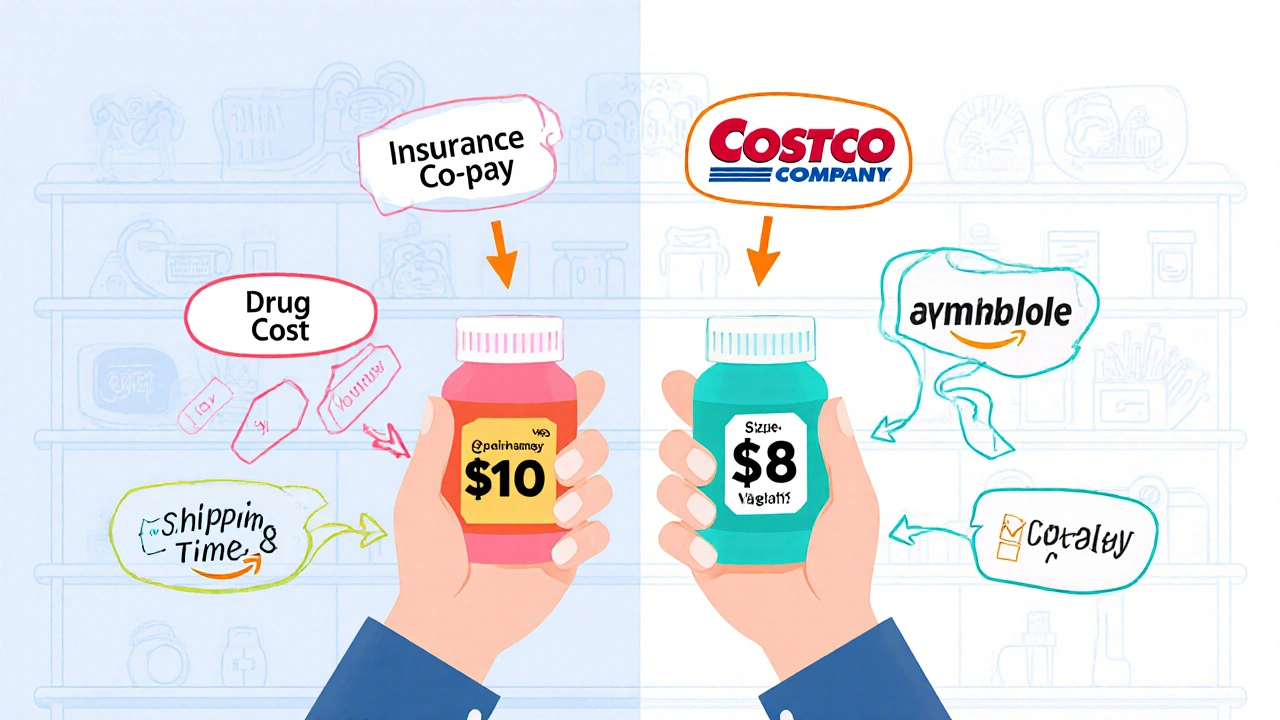

When you walk into the pharmacy, the choice isn’t just insurance vs cash pay, the two main ways people pay for prescriptions. Also known as paying out-of-pocket, it’s a decision that can save you hundreds—or cost you thousands—each year. Most assume insurance always means lower prices, but that’s not true. In fact, for many common meds like generic metformin, lisinopril, or azithromycin, the cash price at Walmart, Costco, or CVS is often cheaper than your insurance copay. Why? Because insurers negotiate secret prices with pharmacies, and sometimes those deals don’t pass savings to you. Your deductible might be high, your copay might be $40, but the cash price is $10.

That’s where pharmacy pricing, how drugs are priced at the counter, whether you use insurance or not gets tricky. The list price you see on your insurance statement? It’s not real. The cash price? That’s what the pharmacy actually charges someone without insurance. And pharmacies often have discount programs—like GoodRx or SingleCare—that let you pay that lower cash rate even if you have insurance. You just have to ask. Some people with Medicare Part D or private plans end up paying more because their plan doesn’t count cash payments toward their deductible, locking them into higher costs. Meanwhile, others with high-deductible plans pay nothing out of pocket once they hit their cap, but until then, cash can be the smarter move.

Then there’s out-of-pocket costs, what you actually pay before insurance kicks in or if you don’t have coverage. This isn’t just about the price of the pill. It’s about whether your plan requires prior authorization, step therapy, or limits how much you can get per month. For example, if your insurance only covers one brand of metformin but you need a different formulation, you might pay full price for a generic that’s just as good. Or if you’re on a chronic med like allopurinol or hydroxychloroquine, paying cash every month adds up fast—unless you use a discount card or buy in bulk. And don’t forget: some meds, like GLP-1 weight loss drugs, aren’t covered at all by many plans, making cash pay the only option. That’s why knowing the real price before you fill the prescription matters more than ever.

It’s not about being pro-insurance or anti-insurance. It’s about being informed. The system is designed to confuse you. Your doctor doesn’t always know the cash price. Your pharmacist might not tell you about discounts unless you ask. But you can change that. Use apps to compare prices. Call your local pharmacy and ask: "What’s your cash price for this?" Then ask: "Can I use this instead of my insurance?" You’d be surprised how often the answer is yes. And if you’re paying cash for meds like prednisone, furosemide, or azithromycin, you’re likely already saving money without realizing it.

Below, you’ll find real-world guides that break down exactly how these decisions play out—whether you’re managing gout with allopurinol, treating high blood pressure with hydrochlorothiazide, or trying to cut costs on antidepressants. These aren’t theoretical tips. They’re lessons from people who’ve been there, figured out the system, and paid less. You don’t need to guess anymore.