Why Generic Drug Coverage Matters More Than You Think

When you switch health plans, most people focus on monthly premiums or doctor networks. But one of the biggest hidden costs? How your new plan covers the generic medications you take every day. A $5 copay for your blood pressure pill can jump to $40 overnight if the plan puts it in a higher tier. That’s not a small change-it’s $480 extra a year. And if you’re on three or four generics? You could be paying over $1,000 more annually just because you didn’t check the formulary.

Generic drugs make up 90% of all prescriptions filled in the U.S., yet they account for only 23% of total drug spending. That’s because they work the same as brand-name drugs but cost a fraction. But here’s the catch: not all plans treat them the same. Some charge $3. Others charge $30. Some waive your deductible for generics. Others make you pay the full deductible before you even see a discount. If you don’t know the difference, you’re leaving money on the table-or worse, skipping doses because you can’t afford them.

How Formularies Work: The Four-Tier System (and Why It’s Not Always Fair)

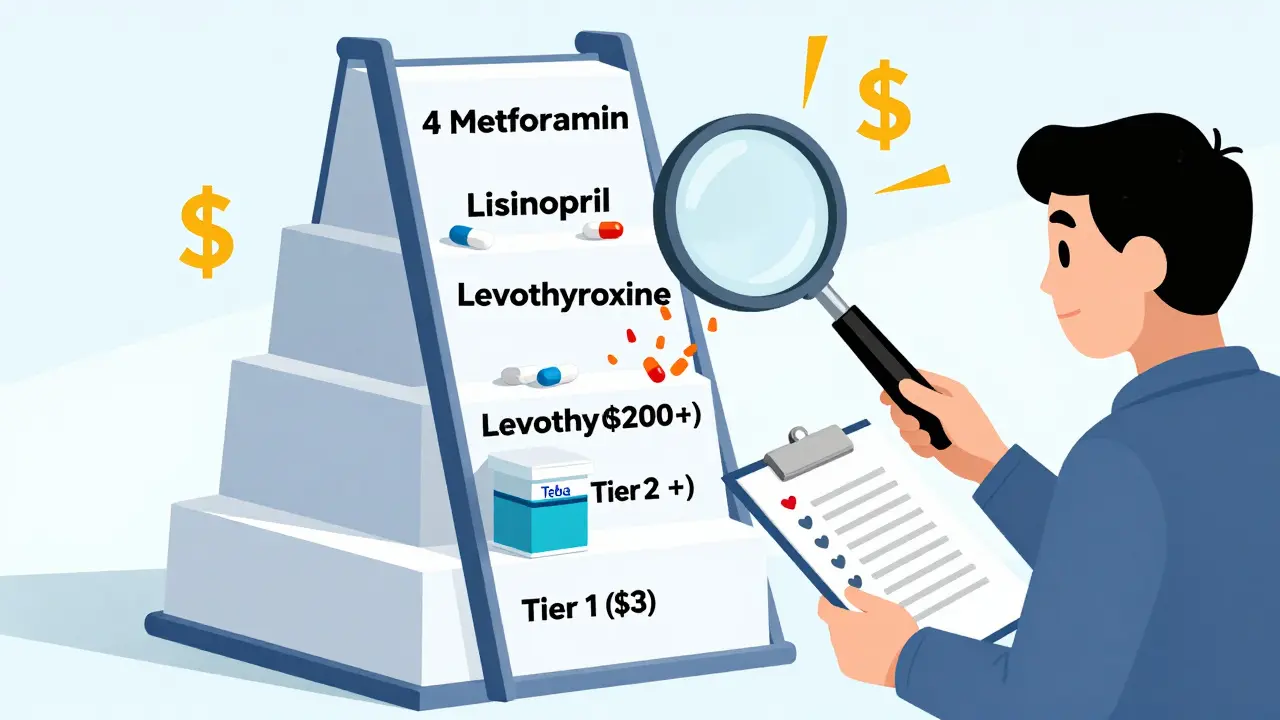

Almost every health plan uses a tiered formulary to control drug costs. Think of it like a pricing ladder. The lower the tier, the cheaper your copay. Here’s how it usually breaks down:

- Tier 1: Preferred generics. These are the cheapest. Copays range from $3 to $20 for a 30-day supply. Most plans put common drugs like metformin, lisinopril, and levothyroxine here.

- Tier 2: Non-preferred generics or preferred brand-name drugs. Copays jump to $20-$50. Sometimes, the same generic drug from a different manufacturer gets moved here.

- Tier 3: Non-preferred brand-name drugs. You’re paying more-often $50-$100.

- Tier 4: Specialty drugs. Even if it’s a generic specialty drug (like a generic version of Humira), you might pay 30% coinsurance or $200+ per prescription.

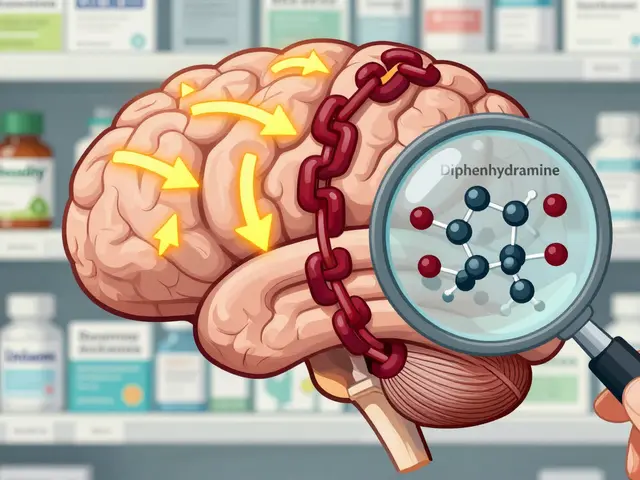

Here’s the problem: plans don’t have to tell you why a drug moved tiers. One year, your metformin is in Tier 1. Next year, it’s in Tier 2-same active ingredient, same manufacturer, same pill. But the plan changed its preferred list. No warning. No explanation. You just get a bill you didn’t expect.

Medicare Part D vs. Marketplace Plans: Big Differences in How Generics Are Covered

If you’re on Medicare, your drug coverage comes through Part D. If you’re under 65 and bought a plan on Healthcare.gov, you’re in the marketplace. These are two very different systems.

Medicare Part D: In 2023, the base deductible was $505. After that, most plans charge $0-$10 for Tier 1 generics. But here’s the twist: some Medicare Advantage plans (MA-PDs) bundle medical and drug coverage. That means you might have to meet a combined deductible before any drug coverage kicks in-even for generics. That’s a trap. You think you’re getting a $10 copay, but you haven’t hit your $2,000 deductible yet. You’re paying full price.

Marketplace plans: Silver plans with Special Design (SPD) are the gold standard for generic users. These plans waive your deductible for Tier 1 generics. You pay a flat $20 copay-even if you haven’t met your medical deductible. That’s huge. For someone taking three generics a month, that’s $720 saved a year compared to a non-SPD plan. But only 32 states offered SPD plans in 2024. If you’re in a state without them, your plan likely requires you to pay the full deductible before generics are covered.

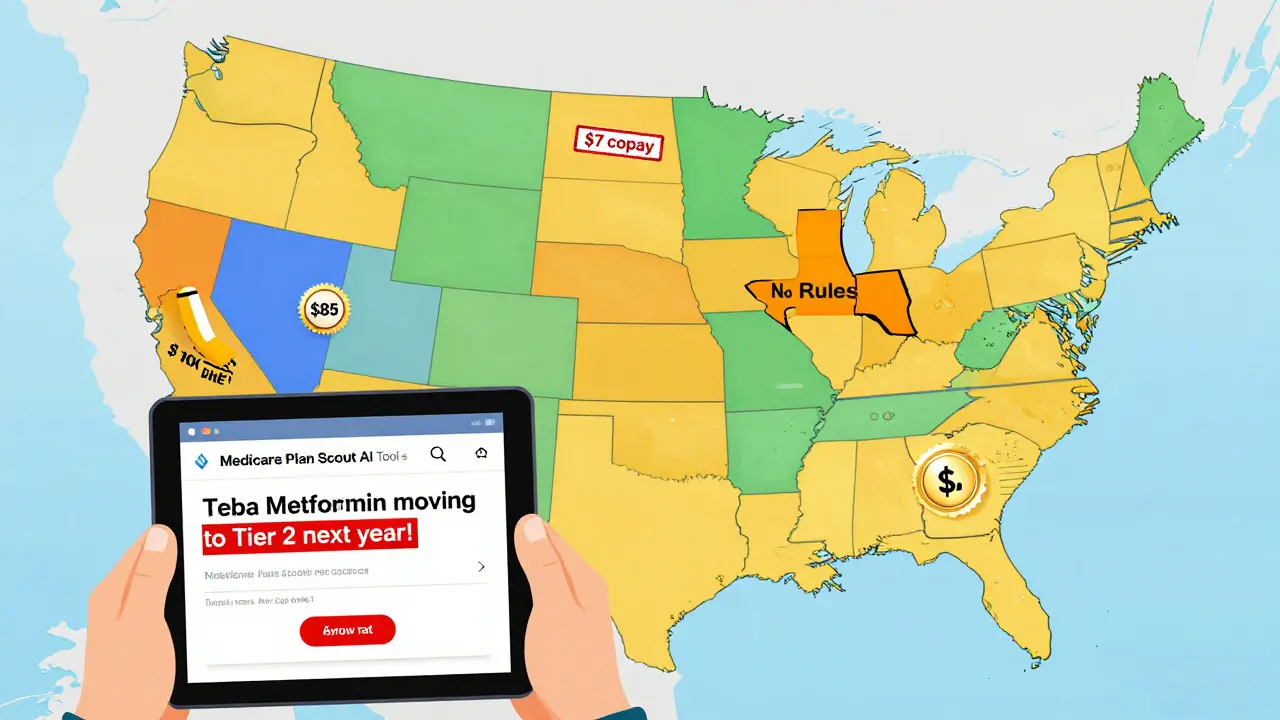

State Rules Change Everything: Why Where You Live Matters

California has a $85 outpatient drug deductible. Once you hit that, you pay 20% coinsurance on generics-capped at $250 a year. New York? No deductible for generics. Just a $7 copay. DC has a separate $350 drug deductible, but caps specialty drugs at $150. Texas? No state rules-so your plan can charge whatever it wants.

These differences aren’t theoretical. A 2023 KFF study found that people in states with separate drug deductibles had 22% higher adherence to their medications. Why? Because they knew exactly what they’d pay. No surprises. In states with integrated deductibles (medical + drug), people skipped pills because they didn’t know how much they’d owe until they hit $3,000 in medical spending.

The #1 Mistake People Make When Switching Plans

You check if your doctor is in-network. You look at the monthly premium. Then you assume your meds are covered.

That’s wrong.

Most people don’t check the exact formulation. For example, your metformin is made by Teva. Your new plan covers metformin-but only the version made by Mylan. Teva’s version? It’s in Tier 2. $35 copay. Same active ingredient. Same dosage. But the plan doesn’t list it as preferred. You won’t know until you fill the prescription.

Another common mistake: mail-order vs. retail. Some plans charge $5 for a 90-day mail-order supply of a generic. But if you pick it up at CVS, it’s $25. You think you’re saving money by switching plans. Then you realize you have to switch pharmacies too.

And don’t forget pharmacy networks. If your local pharmacy isn’t in-network, your $3 copay becomes $45. OptumRx found that 30-40% of people pay way more because they didn’t check which pharmacies their plan covers.

How to Check Your Generic Coverage (Step by Step)

Here’s what you actually need to do before you switch:

- Get your current list. Write down every medication you take-name, dosage, frequency. Include generics and brand names.

- Find the new plan’s full formulary. Don’t trust the summary page. Go to the insurer’s website and download the complete list. Look for the exact drug name and manufacturer.

- Check the tier and copay. Note the cost for a 30-day and 90-day supply. Is it a copay or coinsurance? Is there a deductible? Does it apply to generics?

- Verify the pharmacy network. Is your local pharmacy in-network? If not, how far is the nearest one? Will you pay more for mail order?

- Use a cost calculator. Medicare.gov’s Plan Finder and Healthcare.gov’s plan selector let you enter your drugs and see estimated annual costs. Use them. They’re accurate and free.

People who follow all five steps reduce unexpected drug costs by 73%, according to CMS. That’s not a small number. That’s hundreds-or thousands-of dollars saved.

What’s Changing in 2025 and Beyond

Things are shifting fast. Starting in 2025, Medicare Part D will cap out-of-pocket drug spending at $2,000 a year. That’s huge. But it also means plans will get more aggressive about tiering generics to stay under budget. You might see more drugs moved from Tier 1 to Tier 2.

Also, more states are passing laws to ban integrated deductibles. By 2027, McKinsey predicts 80% of marketplace plans will have separate drug deductibles-just like Medicare. That’s good news. It means you’ll know exactly what you’re paying for meds, no matter what else you spend on.

And new tools are coming. CMS launched a beta AI tool called Medicare Plan Scout in late 2023. It compares your drugs across plans and flags when a generic you use might be moved to a higher tier. In testing, it cut enrollment errors by 44%.

Real Stories: What Happens When You Don’t Check

One user on Reddit switched from a Medicare Advantage plan to a standalone Part D plan. Her levothyroxine cost $0 under her old plan. Under the new one? 25% coinsurance. She paid $120 a month instead of $5. She didn’t realize until her first refill. She had to switch back.

A man in Florida thought his new employer plan had low premiums. But his generic statin jumped from $5 to $45. He stopped taking it. Six months later, he had a heart attack. His doctor said if he’d kept taking the medication, the event could’ve been avoided.

On the flip side, a woman in Massachusetts switched to a plan with $3 generic copays. She took three meds: metformin, lisinopril, and atorvastatin. Her annual cost dropped from $1,200 to $420. That’s $780 saved. All because she checked the formulary.

Bottom Line: Don’t Guess. Verify.

Switching health plans is a big decision. But the biggest financial impact doesn’t come from the premium-it comes from the drugs you take every day. Generic medications are your best friend for saving money. But only if your plan treats them like one.

Take 30 minutes before you enroll. Write down your drugs. Check the formulary. Use the calculator. Call the insurer if something’s unclear. You’ll avoid surprise bills, skipped doses, and even serious health risks. And you’ll keep more of your money where it belongs-in your pocket, not the pharmacy counter.

How do I know if my generic drug is covered by a new health plan?

Download the full formulary from the plan’s website-not just the summary. Look up your drug by its exact name and manufacturer. Check the tier and copay. If it’s not listed, call the insurer. Many plans don’t list every generic version, so verification is key.

Are all generic drugs treated the same across health plans?

No. Two identical generic drugs (same active ingredient, same dosage) can be in different tiers based on the manufacturer. One plan might prefer Teva’s metformin, another might prefer Mylan’s. The plan decides based on contracts with manufacturers-not on drug effectiveness.

Do I have to meet a deductible before my generic drugs are covered?

It depends. In Silver Standardized Plans (SPD) on Healthcare.gov, deductibles are waived for Tier 1 generics-you pay a flat $20 copay. In most other plans, including many Medicare Part D and employer plans, you must meet your deductible first. Always check the plan’s drug coverage rules.

Can I switch plans just to get better generic drug coverage?

Yes-during open enrollment (November 1 to December 15 for Medicare, November 1 to January 15 for marketplace plans). You can switch even if you’re happy with your doctor, as long as your drugs are covered better. Don’t wait until you get a bill-plan ahead.

What if my generic drug is removed from the formulary next year?

Insurers must notify you 60 days before removing a drug. You can request a formulary exception, appeal the decision, or switch plans during the next open enrollment. Keep records of your prescriptions and costs-this helps if you need to appeal.

Are there tools to compare generic drug costs between plans?

Yes. Use Medicare.gov’s Plan Finder for Medicare plans. For marketplace plans, use Healthcare.gov’s plan selector. Both let you enter your medications and see estimated annual costs. Third-party tools like eHealthInsurance’s calculator also work well and are free to use.

15 Comments

Ansley Mayson

This post is just a long-winded ad for insurance brokers. Nobody cares about tiered formularies. Just take your pills or don't. Life's too short to micromanage $3 copays.

phara don

Wait so if my metformin switches from Teva to Mylan and the copay jumps... is that even legal? 🤔

Hannah Gliane

Oh sweet jesus another person who thinks generics are magic 🙄 I've been on 7 different plans in 5 years and every single one tried to screw me on my thyroid med. The system is rigged. 💅

Murarikar Satishwar

Excellent breakdown. Many overlook the manufacturer-specific tiering. In India, we don't have this complexity-generics are uniformly affordable. But in the US, the pharmaceutical lobbying is staggering. A well-researched piece.

Dan Pearson

You people are losing your minds over $40 pills. I work at a pharmacy. Half the people who complain about tiered generics don't even take them consistently. You want cheap meds? Stop being lazy and get a Medicare Advantage plan. Or move to Canada. 🇺🇸

Eli Kiseop

i just checked my plan and my lisinopril went from $3 to $25 wtf

Ellie Norris

This is so helpful! I didn't even know about SPD plans. I'm in the UK so our NHS is a dream but I have family in Texas and they're getting wrecked by this. Thanks for the clarity 😊

Marc Durocher

I used to be the guy who just took his meds and moved on. Then my dad had a stroke because he skipped his statin after a $40 copay spike. Now I check every formulary like it's a treasure map. Don't be that guy.

larry keenan

The structural inefficiencies in U.S. pharmaceutical reimbursement mechanisms are exacerbated by the absence of centralized formulary governance. The tiered copayment architecture, while ostensibly cost-containment-oriented, introduces significant behavioral disincentives for therapeutic adherence.

Nick Flake

This isn't just about money. It's about dignity. When you have to choose between your blood pressure med and your kid's lunch, the system has already lost. 💔 We're not asking for luxury. We're asking to not die because of a paperwork glitch.

Akhona Myeki

The United States has the most advanced pharmaceutical industry in the world. If you cannot navigate the formulary system, it is not the system's fault. You lack the intellectual capacity to manage your own healthcare. Take responsibility.

Chinmoy Kumar

man i just learned about this from my cousin in delhi who works in a clinic. here they just give you the generic and its like 20 rupees. i feel bad for folks in us. we gotta fix this somehow

Brett MacDonald

i think the real issue is capitalism. we treat health like a commodity. but like... what if we just stopped doing that? idk man. just a thought

Sandeep Kumar

Why are you all so weak? In India we pay 10 rupees for generics and we don't whine. You Americans think you deserve free stuff. Grow up.

Gary Mitts

Check your formulary. It's not hard. Seriously. Do it.