When a drug’s patent runs out, something predictable but powerful happens: prices plunge. Not a little. Not slowly. Often, they drop by 80% or more within a few years. This isn’t magic. It’s basic economics-competition kicks in, and suddenly, a $1,000-a-month pill becomes a $10 generic. But the road to that price drop isn’t simple. It’s tangled in legal strategies, regulatory delays, and corporate maneuvering that can stretch out the high-cost phase for years-even after the patent officially expires.

What Happens When a Patent Expires?

Every new drug starts with a 20-year patent clock. That’s the legal shield that lets the original company charge whatever it wants, with no competition. That’s how they recoup the billions spent on research and clinical trials. But once that clock hits zero, other companies can legally make the same drug. These are called generics. And they don’t need to repeat expensive clinical trials. They just need to prove they work the same way. The first generic to enter the market usually cuts the price by 15-20%. That’s a big jump. But the real price collapse comes when the second, third, and tenth generics arrive. By year five, if a drug has five or more generic makers, it’s common for prices to fall to 10-20% of the original. In the U.S., where generic competition is fierce and unregulated, prices for drugs like Eliquis (apixaban) dropped from $850 a month to under $10 after generics launched in 2020. That’s a 98% drop.Why Do Prices Drop So Much?

It’s simple math: more sellers = lower prices. Generic manufacturers don’t have to spend millions on R&D. Their biggest cost is making the active ingredient and getting FDA approval. Once they’re in, they compete on price. And since the drug’s formula is public, anyone can make it. That’s why prices keep falling as more companies join the race. The FDA approved 870 generic drugs in 2023 alone-a 12% increase from the year before. Many of these were for high-cost brand-name drugs whose patents had just expired. The result? Billions saved. The Congressional Budget Office estimates that generic and biosimilar competition will save the U.S. healthcare system $1.7 trillion over the next decade. But here’s the catch: not all drugs follow the same pattern. Small molecule drugs-like blood thinners, statins, and antidepressants-see the fastest and deepest price drops. Complex drugs, like biologics (injectables made from living cells), are harder to copy. These require biosimilars, which take longer to approve and cost more to develop. That’s why Humira, a biologic for arthritis, didn’t see real price drops until 2023-nearly seven years after its main patent expired.The Patent Thicket Problem

Companies don’t just sit back and wait for their patent to expire. They file dozens-sometimes over a hundred-secondary patents on tiny changes: a new pill coating, a different dosage schedule, a slightly altered delivery method. These aren’t new drugs. They’re legal tricks. And they work. The I-MAK 2025 report found that 78% of new patents filed on existing drugs weren’t for actual innovations. They were for minor tweaks designed to delay competition. For example, the diabetes and weight-loss drug semaglutide (Ozempic, Wegovy) has 142 patents covering different formulations and uses. Even though the core patent expires in 2026, these secondary patents could block generics until 2036. This practice, called “evergreening,” is common. The R Street Institute found that 70% of the top 100 prescribed drugs had their market exclusivity extended at least once. In some cases, it was extended multiple times. That means patients and insurers pay high prices longer than they should.

International Differences: Why Prices Drop Faster in Some Countries

The U.S. doesn’t have the biggest price drops. It has the biggest drops. A 2023 study in JAMA Health Forum looked at eight wealthy countries. After eight years, drug prices fell:- 82% in the U.S.

- 64% in Australia

- 60% in the UK

- 58% in Germany

- 53% in France

- 48% in Canada

- 42% in Japan

- 18% in Switzerland

How Patients Actually Experience the Price Drop

Real people feel this shift. On Reddit, patients posted about switching from Eliquis to its generic version: $850 a month down to $10. That’s life-changing for someone on a fixed income. A 2023 Kaiser Family Foundation survey found 68% of insured adults saw lower out-of-pocket costs after generics launched. But it’s not always smooth. Some patients got confused when Humira biosimilars arrived in 2023. The new versions were approved, but pharmacies kept dispensing the original because insurers hadn’t updated their formularies. Others found their copay didn’t drop because the rebate structure still favored the brand. Dr. Sarah Kim, a rheumatologist in Chicago, says she’s seen this firsthand. “We’ve had patients switch to biosimilars for infliximab and save thousands. But with Humira, the transition has been slow. Payers have contracts with AbbVie that make it hard to switch.”

What’s Being Done to Fix the System?

Regulators are starting to push back. In 2023, the U.S. Patent Office launched reforms targeting “patent thickets.” The European Commission proposed limits on supplementary protection certificates that extend drug exclusivity. The FDA has sped up approvals for complex generics, cutting approval times from 30 months to under 20 for some products. The Inflation Reduction Act also introduced Medicare drug price negotiations. That’s a big deal. For the first time, the government can directly negotiate prices for a handful of high-cost drugs. That’s already pushing manufacturers to think twice about when to launch generics-some are delaying entry to avoid triggering negotiation rules. The European Medicines Agency aims to get biosimilar adoption up to 70% within three years of patent expiry. Right now, it’s around 45%. That gap shows how much room there is to grow.What’s Next?

Over the next five years, drugs worth $220 billion in annual sales will lose patent protection. That includes blockbuster drugs like Wegovy, Ozempic, and Eliquis. If generics enter fast, patients could save hundreds of billions. But if companies keep using patent thickets, those savings could be delayed by four years or more per drug. The system was designed to balance innovation with access. But today, it’s tilted too far toward protection. The original promise of the Hatch-Waxman Act-affordable generics after patents expire-is still valid. But the loopholes have grown bigger than the intent. The key takeaway? Patent expiration doesn’t automatically mean lower prices. It means the potential for lower prices. Whether patients actually see those savings depends on how fast generics enter, how regulators respond, and whether insurers and pharmacies put patient costs first.How long does it take for drug prices to drop after a patent expires?

It varies. The first generic usually hits the market within 6 to 18 months after patent expiry, and prices start dropping then. The biggest drops happen between years 2 and 5, especially when 5 or more generic makers enter. In the U.S., prices can fall 80% or more by year 8. In countries with stronger price controls, like Germany or Australia, the drop happens faster and is more consistent.

Why are some drugs still expensive after their patent expires?

There are two main reasons. First, companies file dozens of secondary patents on small changes-like a new pill shape or delivery method-to delay generics. Second, even when generics are available, insurance companies may still cover the brand-name drug if the manufacturer pays them a rebate. That means patients don’t get the lower price unless they specifically ask for the generic or their insurer updates their formulary.

Are generic drugs as effective as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name drug. They must also prove they work the same way in the body. Studies show generics are just as safe and effective. The only differences are in inactive ingredients like fillers or coatings-which don’t affect how the drug works.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs made from chemicals. Biosimilars are highly similar-but not identical-versions of complex biologic drugs made from living cells. Because biologics are more complex, biosimilars require more testing to prove they’re safe and effective. That’s why they take longer to develop and approve, and why their price drops are slower than those of traditional generics.

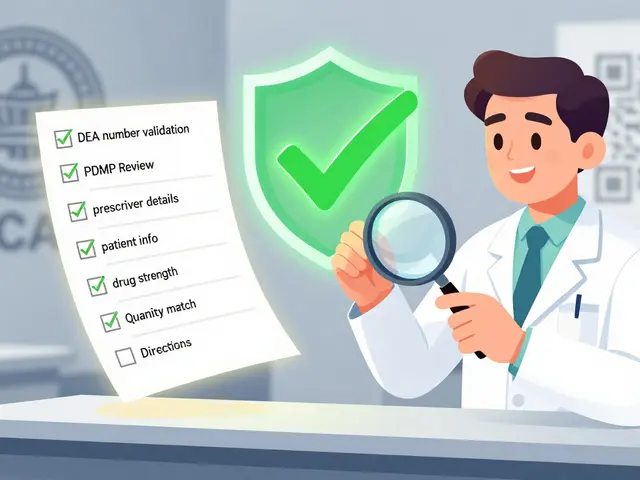

Can I ask my pharmacist to switch me to a generic?

In 49 U.S. states, pharmacists can automatically substitute a generic for a brand-name drug unless the doctor writes “dispense as written” on the prescription. Always check with your pharmacist when a new generic becomes available. They can tell you if a lower-cost option exists and whether your insurance covers it.

Will patent expirations lower my health insurance premiums?

Not directly. Premiums are based on overall risk and administrative costs, not just drug prices. But when drug spending drops because of generics, it can reduce pressure on insurers to raise premiums. Over time, this can help slow the rate of premium increases. For Medicare Part D, lower drug costs mean lower out-of-pocket caps for beneficiaries.

What drugs are losing patents soon?

In 2026, the base patent for semaglutide (Ozempic, Wegovy) expires. However, over 140 secondary patents may delay generics until 2036. Other major drugs with upcoming patent cliffs include Eliquis (2026), Xarelto (2027), and Enbrel (2029). Biosimilars for Humira are already on the market, but competition is still growing. Always check DrugPatentWatch or the FDA’s Orange Book for the latest expiration dates.

14 Comments

Trevor Davis

Just switched my Eliquis to the generic last month. My wallet cried tears of joy. $850 to $12? That’s not a savings-it’s a miracle. I didn’t even have to ask for it; my pharmacist just handed it over like it was normal. Which, honestly, it should be.

Why are we still acting like this is some kind of gift from Big Pharma?

Alan Lin

Let me be clear: this is not a market failure. This is a systemic betrayal. The Hatch-Waxman Act was designed to ensure affordable access after patent expiration. What we have today is a legal fiction where corporations weaponize patent thickets to extract rent from sick people. This isn’t capitalism-it’s feudalism with FDA forms.

The fact that semaglutide has 142 patents is not innovation. It’s extortion dressed up as intellectual property. And until we dismantle this architecture of delay, we are complicit in the suffering of millions.

James Castner

Think about it philosophically: patents were never meant to be permanent monopolies. They were a social contract-give us 20 years of exclusivity, and in return, you give us the knowledge to build upon. But now, the contract is broken. The original promise-affordable generics after expiration-isn’t just delayed; it’s actively sabotaged.

We’ve turned medicine into a casino where the house always wins, and the players are people who need insulin to live. The real question isn’t whether generics work-it’s whether we still believe in justice. Because if we don’t, then what are we even doing here?

John Pope

Okay but like… have you ever seen the way Big Pharma markets these drugs? It’s not just about patents-it’s about *narrative*. They turn a pill into a lifestyle. Ozempic isn’t just for diabetes anymore-it’s a spiritual journey. A glow-up. A TikTok trend. And guess what? When the patent dies, so does the myth. Suddenly, it’s just a molecule. And nobody wants to pay $1,000 for a molecule.

They’re terrified of the day the aura fades. That’s why they file 142 patents. Not to protect innovation. To protect the illusion.

Adam Vella

It is a well-documented phenomenon in health economics that the entry of multiple generic manufacturers leads to a hyper-competitive pricing environment characterized by diminishing marginal returns on price elasticity. The U.S. FDA’s approval of 870 generics in 2023 represents a significant increase in market density, which directly correlates with a reduction in average wholesale price (AWP) by over 90% for small-molecule therapeutics.

However, this effect is attenuated in biologics due to structural complexity and regulatory barriers inherent in biosimilar approval pathways under the BPCIA. The disparity in price reduction between small molecules and biologics is statistically significant (p < 0.01) and underscores the need for policy reform targeting regulatory inefficiencies.

Robin Williams

bro. i just found out my dad’s $1,200/month heart med is now $8 at walmart. he cried. i cried. the system is broken but we’re winning. we’re actually winning. someone somewhere is laughing but we’re getting there. keep going. generics are the people’s revenge.

Angel Molano

You people act like this is a surprise. Drug companies are criminals. They don’t make medicine-they make profit engines. If you’re still paying brand prices after generics exist, you’re not just being ripped off-you’re enabling it. Stop being passive. Demand the generic. Call your insurer. Switch. Or shut up.

Vinaypriy Wane

While I appreciate the depth of this analysis, I must respectfully point out that the cultural context of pharmaceutical pricing varies significantly across nations. In India, for instance, generics are produced at a fraction of the cost due to compulsory licensing and robust domestic manufacturing-yet, we still face challenges in equitable distribution. The U.S. model, while aggressive in price reduction, lacks universal access. Perhaps the solution lies not in competition alone, but in equity?

Thank you for this thoughtful post.

Randall Little

So let me get this straight: the U.S. has the biggest price drops… because we have no price controls?

That’s like saying ‘our car gets the best gas mileage because we don’t have speed limits.’

It’s not a victory. It’s a loophole. And the fact that Switzerland’s prices only dropped 18%? That’s not ‘inefficient’-that’s smart policy. We’re proud of being the only rich country where you need a loan to fill a prescription? Congrats.

jefferson fernandes

Everyone’s talking about generics, but what about the pharmacists? They’re the ones who actually make the switch happen-and most of them are underpaid, overworked, and stuck in insurance red tape.

I’ve seen pharmacists spend 45 minutes on the phone with an insurer just to get a patient’s generic covered because the formulary hasn’t been updated. They’re not just dispensing pills-they’re fighting a war with paperwork.

Next time you save $800 on a prescription, thank your pharmacist. They’re the unsung heroes.

Acacia Hendrix

It’s fascinating how the discourse around generics is so fundamentally misaligned with the epistemological framework of pharmaceutical innovation. The very notion that a molecule’s efficacy can be replicated without proprietary formulation nuances ignores the ontological complexity of bioequivalence.

Moreover, the conflation of ‘price drop’ with ‘patient benefit’ is a classic neoliberal fallacy. One must interrogate the underlying power structures of formulary placement, rebate systems, and PBMs-these are the true arbiters of access, not mere patent expiration.

Adam Rivera

My mom’s on a generic statin now. She used to skip doses because it cost $300 a month. Now? She takes it like it’s vitamins. That’s what this is really about-not economics, not patents. It’s dignity.

And honestly? If you’re still buying brand-name drugs after generics exist, you’re not being loyal-you’re being exploited. Ask your doc. Ask your pharmacist. Don’t let greed decide your health.

lucy cooke

Oh, the drama. The sheer, beautiful, tragic drama of it all.

Here we are-humans, dying for pills, while CEOs sip champagne on yachts, counting the seconds until their next patent extension.

And we’re supposed to be grateful for a 98% drop? As if that’s a gift. As if we didn’t pay for the R&D with our taxes, our insurance premiums, our silence.

It’s not a market. It’s a soap opera written by billionaires. And we’re all just extras waiting for our cue to collapse.

John Tran

Okay so like… I read this whole thing and I’m just sitting here wondering-why do we even have patents? Like, if the whole point is to incentivize innovation, then why are we letting companies sit on drugs for 20 years and then drag their feet for another 10 with fake patents? It’s like they’re playing monopoly with people’s lives.

And don’t even get me started on the rebate system. It’s like the insurance companies are getting kickbacks to keep you paying $800 for a pill that costs $10 to make. Who even came up with this? A villain in a cartoon? I’m not mad, I’m just… confused. Like, how did we get here? Did we all just agree to this? Because I don’t remember voting for it.

Also, I just typed ‘biosimilar’ wrong like three times. Sorry. My brain is tired.