When a biologic drug like Humira or Enbrel loses patent protection, you’d expect cheaper versions to flood the market. But that’s not what happened - not at first. In Europe, biosimilars took off within years. In the United States, they stalled for nearly a decade. Why? It’s not about science. It’s about rules, incentives, and how each system handles competition.

What Exactly Is a Biosimilar?

Biosimilars aren’t generics. Generics are exact chemical copies of small-molecule drugs like aspirin or metformin. Biosimilars are highly similar versions of complex, living-cell-based medicines - proteins made in bioreactors, not chemical labs. They’re not identical to the original (called the reference product), but they must show no clinically meaningful difference in safety, purity, or effectiveness. The FDA and EMA both require rigorous testing: analytical studies, animal tests, and at least one clinical trial. But the depth of proof required? That’s where Europe and the U.S. diverged.

Europe: The First Mover with a Clear Roadmap

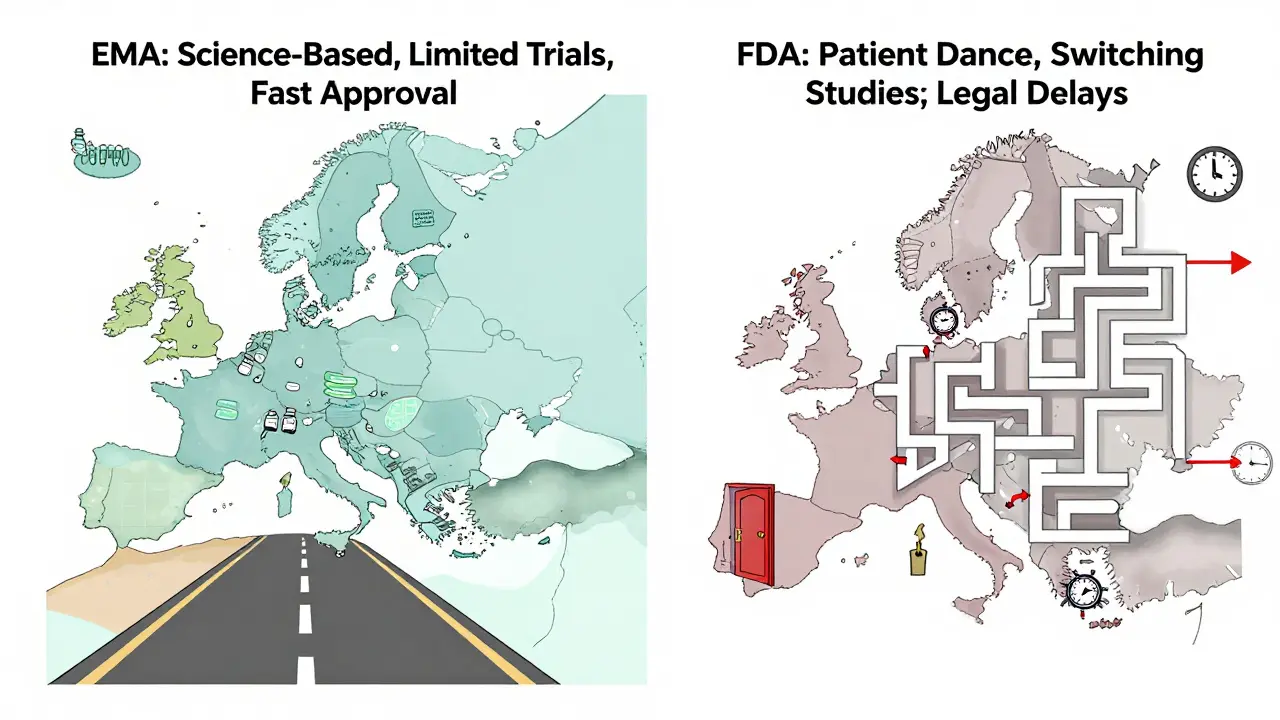

Europe didn’t just get there first - it built the playbook. In 2006, the European Medicines Agency (EMA) approved the world’s first biosimilar, Omnitrope, a version of human growth hormone. That wasn’t luck. The EMA created a clear, science-based pathway: focus on quality, compare molecular structure, test pharmacokinetics, and run limited clinical trials. No need for massive Phase III studies. Just prove you’re the same in action.

That clarity changed everything. By 2024, Europe had approved over 100 biosimilars. Germany, France, and the UK led the charge. Hospitals ran tenders - if a biosimilar was 25% cheaper and just as safe, it won the contract. Payers pushed for substitution. Doctors trusted the data. In rheumatology and oncology, biosimilars now make up over 80% of new prescriptions in countries like Sweden and Denmark.

The result? Europe’s biosimilar market hit $13.16 billion in 2024, growing at 13% annually since 2020. The system worked because it was simple: if it passes the science, it gets used.

The United States: A Slow Start, Then a Surge

The U.S. passed the Biologics Price Competition and Innovation Act (BPCIA) in 2009 - six years after Europe. But the law was tangled. It created a legal minefield called the “patent dance,” where originator companies could delay biosimilar entry with lawsuits. Between 2015 and 2020, only a handful of biosimilars reached the market. The first, Zarxio (a filgrastim biosimilar), took nearly a decade to get here.

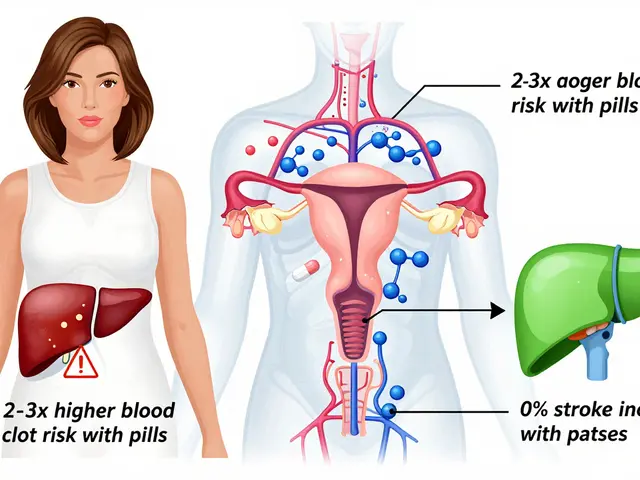

Why? Patent thickets. Aggressive litigation. And a regulatory barrier no one expected: switching studies. The FDA required biosimilars to prove it was safe to switch patients from the reference drug to the biosimilar - even though the drugs were clinically identical. That meant extra trials, extra time, extra cost. Many developers walked away.

By 2024, the U.S. had approved only 20 biosimilars - compared to Europe’s 100+. And while Humira had 14 biosimilars approved, only six were actually on the market because of patent settlements. The rest were locked up in legal battles.

The Turning Point: June 2024

In June 2024, the FDA changed the rules. They dropped the requirement for switching studies to gain “interchangeable” status. That’s huge. Interchangeable means pharmacists can swap the biosimilar for the brand without asking the doctor - just like generics. Before, only a few biosimilars qualified. Now, dozens more can get there faster.

This move didn’t come out of nowhere. It mirrored Europe’s approach. The FDA admitted: switching studies weren’t adding safety. They were just slowing things down. Analysts call it the “Europeanization” of U.S. regulation. And it’s working. The U.S. market jumped from $7.1 billion in 2020 to $10.9 billion in 2024. Projections show it hitting $30.2 billion by 2033 - faster growth than Europe’s.

Who’s Winning? Market Size vs. Growth Rate

Europe still has the bigger market. In 2024, it generated $13.16 billion. The U.S. hit $10.9 billion. But growth? The U.S. is accelerating. IMARC Group projects a 18.5% CAGR for the U.S. through 2033. Europe’s is 17.34%. North America as a whole is expected to overtake Europe in market size by 2027.

Why the shift? Three reasons:

- Patent cliffs: Over 118 biologics will lose exclusivity between 2025 and 2034. Humira alone represents $232 billion in potential savings.

- Inflation Reduction Act: This 2022 law capped insulin costs and eliminated the Medicare Part D donut hole - making biosimilars more attractive to payers.

- Manufacturing scale: Companies like Pfizer, Merck, and Samsung Bioepis are investing billions in U.S.-based production.

Europe’s growth is steady. The U.S.’s is explosive. Europe leads in volume. The U.S. is catching up in speed.

Therapeutic Areas: Where Biosimilars Are Making the Biggest Impact

Europe’s early wins were in autoimmune diseases - drugs for rheumatoid arthritis, Crohn’s, psoriasis. Biosimilars for adalimumab, infliximab, and etanercept now dominate those markets. Oncology followed quickly. In Germany, over 70% of patients starting on a biosimilar for cancer treatment get one.

The U.S. started slow. The first biosimilars were for supportive care: filgrastim (to boost white blood cells after chemo), epoetin (for anemia). These are simpler proteins. Less risk. Easier to copy. But now? The floodgates are opening. Biosimilars for rituximab (lymphoma), bevacizumab (colon cancer), and trastuzumab (breast cancer) are rolling out. By 2026, over half of new oncology biologic prescriptions in the U.S. will be biosimilars.

Manufacturing and Supply Chains

Germany is the biosimilar factory of Europe. Companies like Sandoz, Fresenius Kabi, and Biocon have major production sites there. The country offers skilled labor, strong infrastructure, and centralized procurement. It’s a magnet for global developers.

The U.S. is building its own capacity. Pfizer’s biosimilar plant in Puerto Rico, Merck’s facility in Pennsylvania, and Samsung Bioepis’s U.S. operations are scaling up. The goal? Reduce reliance on overseas manufacturing. The Inflation Reduction Act even includes incentives for domestic biologic production.

Both regions now share similar analytical standards. The science is aligned. The difference? Europe’s system rewards cost savings. The U.S. system is finally learning to do the same.

What’s Next? The Road Ahead

By 2030, biosimilars will save the U.S. healthcare system over $100 billion. In Europe, savings will exceed $150 billion. The biggest opportunities lie in next-generation biologics - longer-acting antibodies, fusion proteins, and cell therapies. These are harder to copy. But both regions are investing in R&D to meet the challenge.

One thing is clear: the U.S. is no longer playing catch-up. It’s leading in innovation. The FDA’s 2024 rule change was the turning point. Now, biosimilars aren’t just cheaper options - they’re becoming the default.

For patients, that means lower out-of-pocket costs. For providers, it means more treatment choices. For the system, it means sustainability.

Why This Matters Beyond the Numbers

Biosimilars aren’t just about saving money. They’re about access. A biologic drug can cost $20,000 a year. A biosimilar? Often under $10,000. That’s the difference between a patient getting treatment - or not.

Europe showed the world it could be done. The U.S. is proving it can be done faster. And together, they’re rewriting the rules of how medicine is priced, prescribed, and paid for.

Are biosimilars the same as generics?

No. Generics are exact chemical copies of small-molecule drugs. Biosimilars are highly similar versions of complex biologic drugs made from living cells. They’re not identical, but they work the same way and have no meaningful difference in safety or effectiveness. The manufacturing process is far more complex, which is why biosimilars cost more than generics - but still far less than the original biologic.

Why did biosimilars take off faster in Europe than in the U.S.?

Europe had a clear, science-focused regulatory path from the start. The EMA required limited clinical data and encouraged hospital procurement systems that favored cost savings. Payers pushed for substitution. Doctors trusted the data. The U.S. had patent lawsuits, legal delays, and a requirement for switching studies - extra trials that slowed approval. The FDA didn’t remove that barrier until June 2024.

Can pharmacists substitute biosimilars for brand-name drugs in the U.S.?

Only if the biosimilar has “interchangeable” status from the FDA. Before 2024, very few did. Now, with the removal of switching study requirements, more are expected to qualify. Even then, state laws vary - some require doctor notification, others allow automatic substitution. It’s still a patchwork, but it’s improving fast.

Which biologics are next to lose patent protection in the U.S.?

Humira (adalimumab) was the biggest, with 14 biosimilars approved by 2024. Next up are biologics for diabetes (like insulin glargine), asthma (like dupilumab), and multiple sclerosis (like natalizumab). Over 118 biologics are expected to lose exclusivity between 2025 and 2034, representing a $232 billion opportunity for biosimilar manufacturers.

Are biosimilars safe?

Yes. Both the FDA and EMA require the same high standards: analytical testing, animal studies, and clinical trials. Hundreds of thousands of patients have used biosimilars in Europe for nearly 20 years with no new safety signals. Real-world data from Germany, Sweden, and the UK confirms they’re as safe and effective as the original drugs. The science is solid.

10 Comments

Jose Mecanico

Really appreciate this breakdown. I work in hospital procurement and seeing the shift in Europe was eye-opening. We started pushing biosimilars last year after our pharmacy team showed us the data. No more guesswork - just cost savings and same outcomes. Patients are happier too, less sticker shock at the pharmacy.

Still weird how long it took the U.S. to catch up, but glad we’re finally moving.

Alex Fortwengler

Oh here we go again - ‘FDA finally woke up.’ Like they didn’t get paid off by Big Pharma for 15 years. Patent dance? That’s not a legal loophole, that’s a cartel. And now they’re acting like they had a brilliant idea? Please. This was forced by inflation and public rage. The FDA’s been asleep at the wheel since 2010. Don’t act like they saved us.

Also, ‘interchangeable’? Yeah right. Pharmacists still can’t swap without a court order in half the states. This is theater, not reform.

jordan shiyangeni

It’s worth noting that the EMA’s regulatory framework, established in 2005 under Regulation (EC) No 1901/2006 and subsequent guidelines, explicitly mandated a stepwise, comparative approach grounded in analytical similarity, non-clinical pharmacokinetic bridging, and targeted clinical immunogenicity assessments - all of which were codified with precision in CHMP/437/04. The U.S. FDA, by contrast, operated under a deliberately ambiguous statutory mandate under the BPCIA, which lacked enforceable timelines, permitted indefinite litigation delays via the so-called ‘patent dance,’ and imposed unnecessary clinical switching studies until June 2024 - a decision that, while pragmatically sound, was a de facto admission of prior regulatory overreach and scientific inconsistency.

Moreover, the structural asymmetry between centralized European procurement systems and the fragmented, insurer-driven U.S. model cannot be overstated. Germany’s Kassenärztliche Vereinigung mandates biosimilar-first prescribing in rheumatology; in the U.S., formulary committees are beholden to rebate structures and pharma marketing teams. The outcome was inevitable: efficiency versus entrenchment.

Abner San Diego

Europe’s great, but they’re not winning. They’re just cheap. We’re building the future - domestic manufacturing, FDA reforms, real innovation. You think Germany’s saving money? They’re just letting their healthcare system collapse under bureaucracy. We’re not playing their game. We’re upgrading it.

And don’t even get me started on how Europe lets foreigners run their pharma plants. We’re making biosimilars right here, in Pennsylvania and Puerto Rico. That’s American ingenuity. Not some EU paperwork miracle.

Eileen Reilly

ok but like… why did it take SO LONG??? like i get the patent stuff but come on. i had a friend on humira for 8 years and her insurance wouldn’t cover the biosimilar till 2023. she paid $12k a year. same drug. same results. just cheaper. whyyyy?

also i saw a pharmacist try to swap mine and got yelled at by the doctor. what even is this system?? 😩

Monica Puglia

This is actually kind of beautiful 🌱

Europe showed us it was possible. We were slow, messy, and stubborn - but we’re learning. The FDA’s move? Huge. It’s not just about cost - it’s about dignity. People shouldn’t have to choose between rent and their biologic. And now? More people will get treated. That’s the win.

Also shoutout to the scientists and pharmacists who kept pushing for this. You didn’t give up. That matters.

steve ker

USA over Europe. End of story. They still cant even pronounce biosimilar right

George Bridges

I’ve worked in both systems - Europe and the U.S. - and the real difference isn’t regulation. It’s culture. In Germany, doctors see biosimilars as part of the public good. In the U.S., they’re often seen as ‘second-tier’ unless proven otherwise. That mindset shift is what changed everything in 2024. The FDA didn’t just change rules - they changed the narrative.

And that’s harder than any law.

Faith Wright

Oh so now the FDA is a hero? After 15 years of letting pharma companies hold the market hostage? I’m sure they’ll take a bow next to the CEOs who spent millions lobbying against biosimilars.

Let’s not pretend this was altruism. It was $232 billion in savings staring them in the face. When the money talks, even regulators listen. 😏

TiM Vince

Just read this while waiting for my kid’s biosimilar infusion. We switched last year. No issues. No drama. Just a $7k annual savings. My wife cried. Not because she was scared - because she finally felt like the system worked for us.

Europe showed the way. We’re just catching up. And it’s about time.